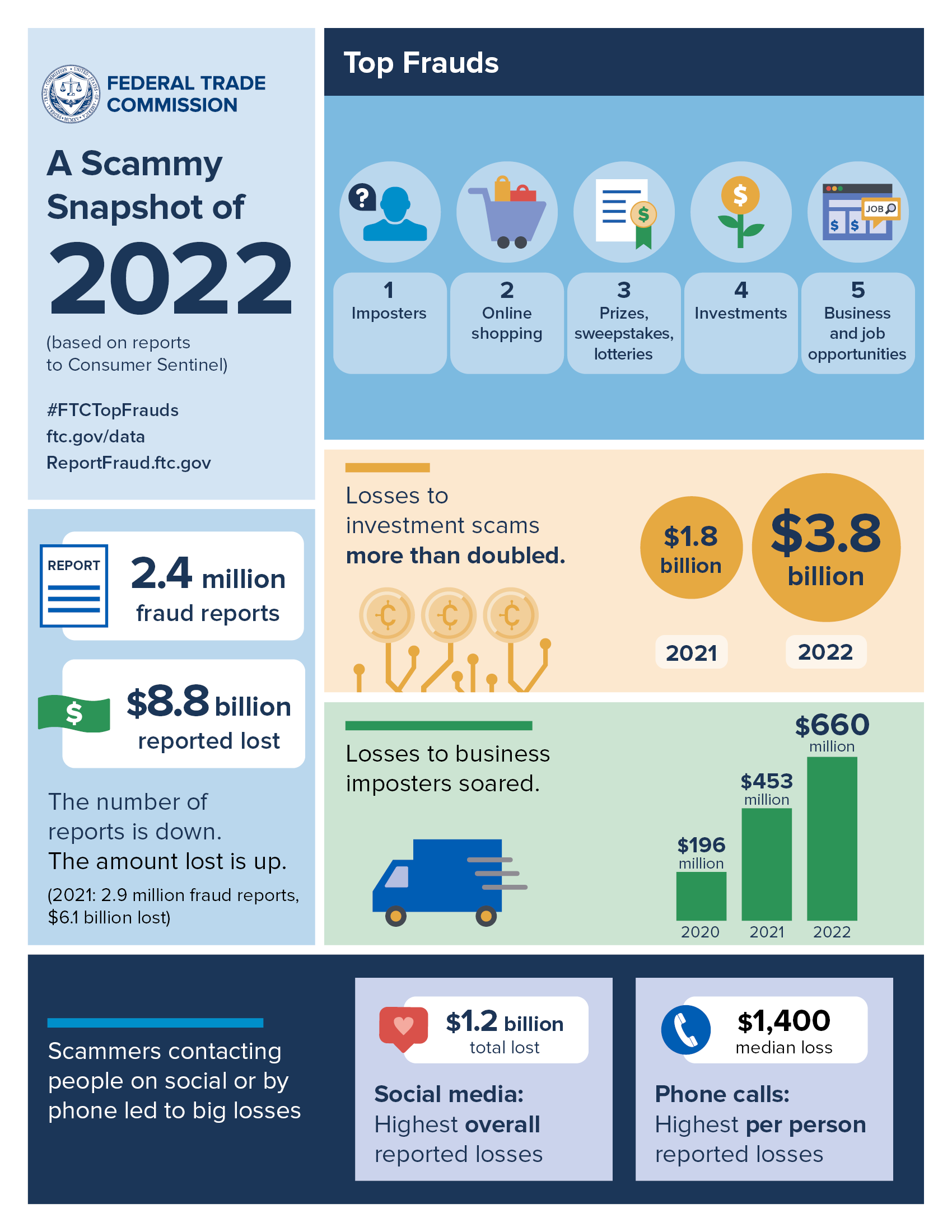

The Federal Trade Commission reports that in 2022, consumers in the United States lost over $8.8 billion due to fraud and scams.

Scams can sometimes be difficult to catch, because while consumers have gotten better at identifying scams over the past several years, fraudsters have also been evolving and coming up with more complex ploys that appear to be legitimate. Read on to learn about the five most common types of scams.

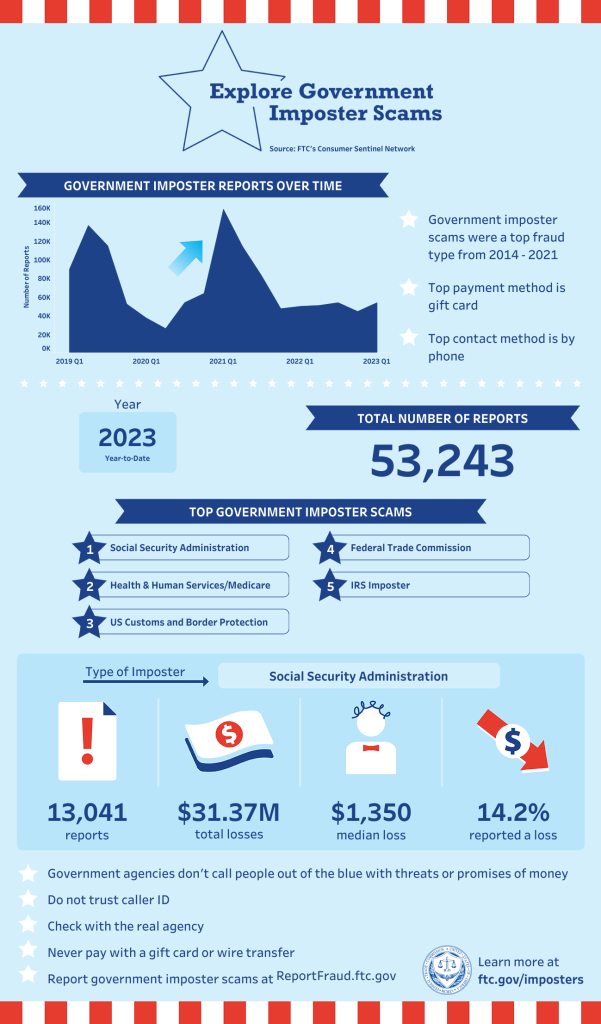

An imposter scam is when the fraudster tells you they are someone they are not to get you to give them money or other items of value (such as buying giftcards or sending them expensive “gifts”). One of the most common types of imposter scam is a government imposter.

How are scam artists able to convince people that their government imposter scam is legitimate?

Another common imposter scam is the “internet boyfriend/girlfriend/partner/fiance.” The fraudster chooses someone on the internet who they think is vulnerable and convince that person to send them money or expensive gifts. Sometimes, they don’t even ask outright for items, but they will say things to manipulate the victim into offering the gifts. The fraudster will often make excuses for why they are unable to meet in person, and sometimes will not even video call or talk on the phone. Be wary of any relationship that starts on the internet to protect yourself from a possible scam.

With this type of scam, the fraudster sets up what might appear to be a legitimate business website or social media page and market fake services or goods. After the person enters their payment information and fails to receive what they paid for, they find out that the customer service phone/email is bogus and the website or social media page has been deleted or disabled.

The best way to make sure the business you’re buying from is legitimate is to look for reviews online. Even just searching the business name in a search engine can often tell you 1) if the business is legitimate, 2) how long they’ve been in business (a newer business is more likely to be a scam in disguise than one that has been around for a decade), and 3) what the customer service is like.

General rule of thumb: If the business website/social media page is less than a year old, has little to no reviews (or bad reviews that say people didn’t receive their items), and/or contains several typos, be wary of purchasing from them.

If you receive a phone call, email, or social media reply which claims you have won some sort of prize, sweepstakes, or lottery, do not provide any personal information (such as address, bank account numbers, etc). Another red flag is if they tell you that you have to pay for shipping, processing, or tax over the phone. Like with online shopping, you can Google the business/organization to verify if they are a legitimate entity.

Investment scams occur when a person convinces you to invest in their business, stocks, real estate, or other securities with the intention of stealing the money you think you are investing.

It’s important that if you decide to invest in something, you do so through a trusted person or entity.

Business and job opportunity scams are becoming more prevalent on social media and job listing sites. These scams often advertise desirable characteristics, such as being entirely remote, providing high pay, or have a very vague explanation of the duties and/or compensation.

Never provide your personal information (such as address, direct deposit information, social security number, etc.) to a potential employer until you have confirmed that they are a legitimate entity.

If you think you have been scammed or your identity has been compromised, be sure to reach out to the credit bureaus to freeze your credit, and report it to your financial institution and the proper authorities.

We focus on more than just your financial journey.

At Breakwater, being member-owned means every decision is made with you in mind. We believe in giving back, getting involved, and making a real impact right here in the Copper Country.

Because life is better when we do good together.

700 E. Sharon Ave.,

Houghton, MI 49931

Call or Text: 906.482.5005

Fax: 906.482.2451

Email: info@breakwaterfcu.org

© Copyright 2022 Breakwater Federal Credit Union | Privacy Policy