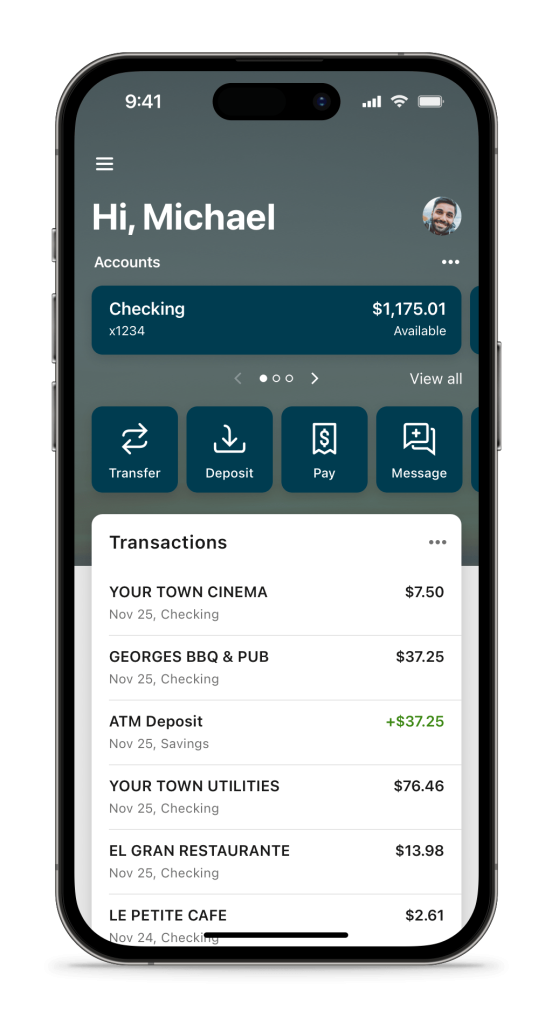

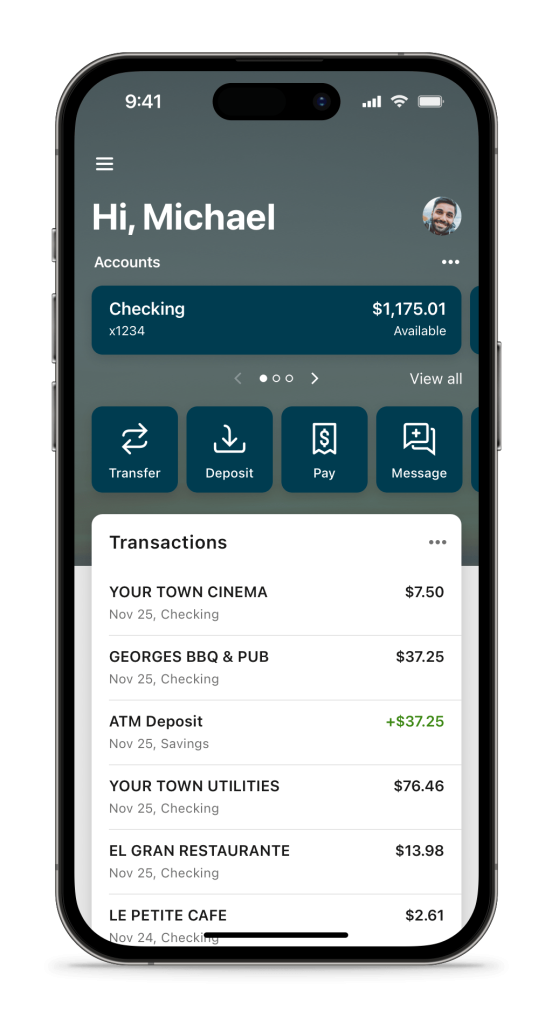

important update

Our new online banking and mobile app are now live and functional.

Click here to access them today!

Please contact us if you have any questions or difficulty with the conversion.

A: First of all, you’ll want to submit a travel notification. You can do this under “Card Controls” on our mobile app, by calling us, or by stopping by to talk to us. This is an important step, because ATM, debit, and credit cards have fraud protection on them that will flag potentially suspicious activity, so we need to know that the transactions you’re making while you travel are not fraudulent.

Also, as part of the MoneyPass network, you have access to over 37,000 no-fee ATMs all over the country! Just search the zip code you’ll be in/passing through on the MoneyPass website and use your BFCU card to make no-fee transactions.

A: We have a handy, downloadable guide that lists all of the tasks you can accomplish remotely. You can also drop most items off in our night drop box, which is located on the side of the building right before the drive-up window. We also recently added two new ATMs to our drive-thru, both of which accept deposits of cash and checks.

A: Please visit our page on Transfers to find out how to move your money between accounts.

A: When you mobile deposit a check using our app, the first $225 is automatically released, and a hold is put on the remaining amount. Our Operations department reviews these checks throughout the business day. Please remember to write “For Mobile Deposit Only at BFCU” on the back along with your signature, or we will be unable to deposit the check to your account.

A: There are six convenient ways you can do this:

A: Stop by our Houghton office, and we will help you fill out a seasonal address change form.

If you cannot come in, we can send you the form via Docusign, or you can mail us a note that states the address and is signed by you. If you choose to mail us a note, please make sure to include that this is a temporary address, when it should go into effect, and when you will return to your permanent address.

When you get back to town, our system will automatically revert back to your local address (provided your return matches the expiration date you gave to us).

A: Yes! We have several employees who are licensed to notarize in the State of Michigan, and we’d be happy to help notarize your documents. You do not need an appointment in order to receive notary services.

A: You can enroll yourself! Visit our login page, click “Not a user? Click Here” on the left side of the dark grey bar, and follow the prompts to complete the setup.

What about the mobile app?

If you enroll in online banking, you will automatically be enrolled for the mobile app as well. If you do not have online banking, you can enroll on the app directly by following the instructions in this guide.

Note: The first time you log into the mobile app, a PIN will be sent to your email and you will need to enter it into the app. Please make sure your email with us is up-to-date to ensure this PIN is sent to the correct one.

A: Please email us and we will remove your data from the mobile app/online banking: info@breakwaterfcu.org

A: We can set up something called “preference access” between your credit union accounts. Please contact a Member Service Representative if you would like to do this, and they will guide you through the process. We will require you to sign forms to authorize this, but you can do so via Docusign if you are unable to come in during business hours.

A: We take security and privacy very seriously. As a result, security questions that are pending on your online banking might cause the link to fail. Try logging onto your online banking and answering those questions before attempting to link it again. If you continue to have difficulty, feel free to call, text, or email us.

A: With new technology comes new privacy concerns, new methods of fraud and identity theft, and new methods of approaching security. We know staying secure and protecting your privacy is not an easy task, so we compiled a few resources for our members to reference to help get a better idea of what steps can be taken to maintain your personal privacy and security.

Online Security – Here are some tips to help you stay secure online on your personal computer.

Mobile Security – Here are some tips to help you stay secure on your smartphone or tablet.

A: Whenever we have an open position, we post the opening on Indeed and Facebook. We encourage anyone who is interested to apply! Even if we don’t have any open positions, you can click “Follow” on Indeed to receive notifications when we do open listings.

There’s no question about it: we’re different but in the best way. We make you and your financial well-being our priority.

700 E. Sharon Ave.,

Houghton, MI 49931

Call or Text: 906.482.5005

Fax: 906.482.2451

Email: info@breakwaterfcu.org

© Copyright 2022 Breakwater Federal Credit Union | Privacy Policy

Our new online banking and mobile app are now live and functional.

Click here to access them today!

Please contact us if you have any questions or difficulty with the conversion.