From first-day crayons to dorm-room fans, a smart budget is one of the best school supplies you can have! Here are some practical tips for all age groups to help you prepare for the upcoming year. Here are some back-to-school budgeting tools and ideas to help you prepare for the new school year!

Back-to-school season is a great time to start building healthy money habits. Breakwater offers youth savings accounts to help kids learn the basics of saving, goal-setting, and smart spending. Whether it’s budgeting for school supplies or saving for a field trip, getting kids involved in their finances early sets the stage for a bright financial future.

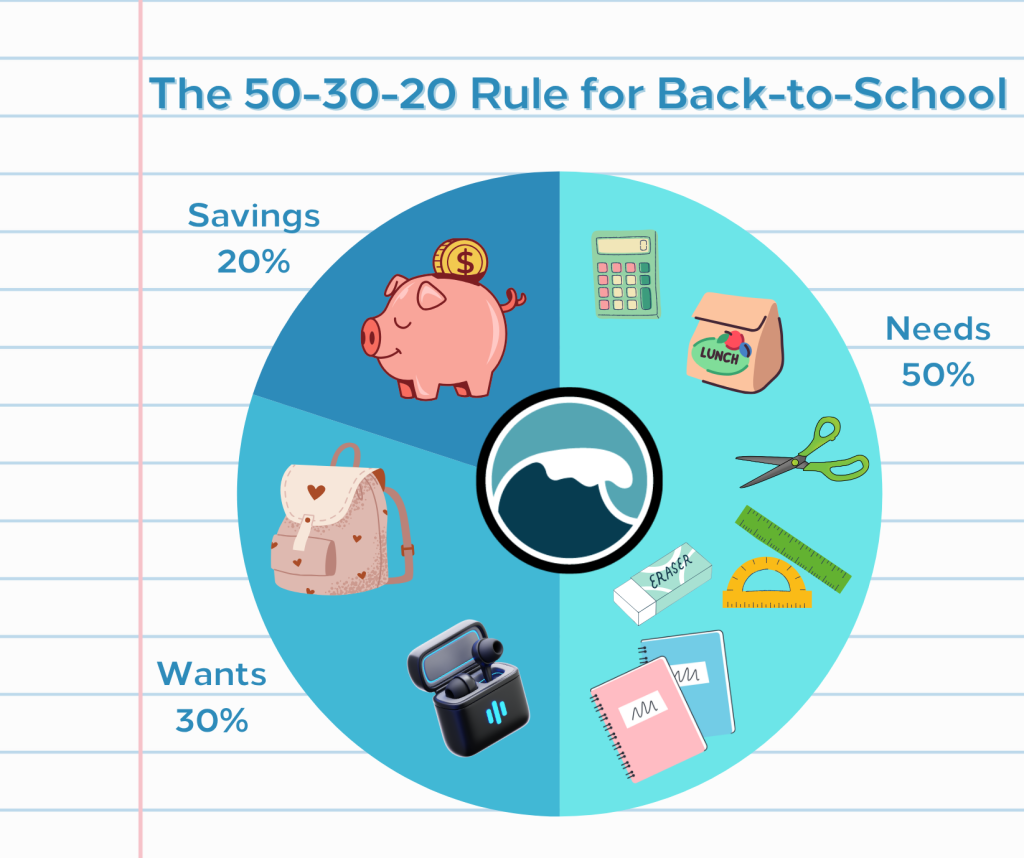

Here are a few simple ways families can budget for the new school year together:

Download our printable Back-to-School Budgeting worksheet to start planning your back-to-school shopping trip. Learn to identify wants versus needs to create an informed budget for the coming school year. The form is also fillable on your computer!

Download PDFWhether you’re heading to high school, starting college, or moving out on your own, now is the time to start taking control of your finances and build smart money habits that stick. From managing everyday expenses to requesting an occasional loan from your parents, Breakwater is here to help make the transition to adulthood a little smoother.

Here are a few ways Breakwater can support your journey as a financially responsible young adult:

Think you have what it takes to budget for rent, groceries, a vehicle, and other everyday living expenses? Complete our budget worksheet and see if you can break even after one month in our adult budget simulation.

Download PDF